I should admit, I am a software program junkie. I like right software that works as it ought to and does its process with a minimum of an attempt on my part. When I first started the use of a laptop at domestic, one of the first matters I commenced searching out turned into a software program that might manage my budget and permit me to keep up with what I spend. It is essential for me due to the fact although I do now not have a variety of distinct finances to keep up with, I need all the help I can get. I began the usage of Microsoft Money and even as I honestly just like the way it operated, it did have it is drawbacks. Chief amongst them is the very obtrusive advertisements and the truth that Microsoft Money (you pick out the year) would not open a superbly precise cash document that has been opened even once inside the next yr’s model of Money. I can see that being the case every from time to time when the record format has to trade for something purpose but to do it every yr is a piece of the pinnacle. The subsequent program I used become AceMoney and I used it until I converted from Windows XP to Linux nearly years in the past.

When I commenced the use of Linux, I knew I could use AceMoney on my Linux system, as long as I hooked up Wine, which lets in Windows packages to run on Linux, however, I chose now not to do so. I preferred to use a software that turned into designed to run on Linux itself. After performing some research online, I determined to take advantage of a loose trial presented by using Moneydance, an open source, move-platform personal finance manager for Windows, Linux, and Mac OS. It took a chunk of gambling around with the software program before I was used to the manner it does things, however, when I did, I had no hassle shopping the full version for $29.99. In my opinion, it’s miles nicely well worth the charge.

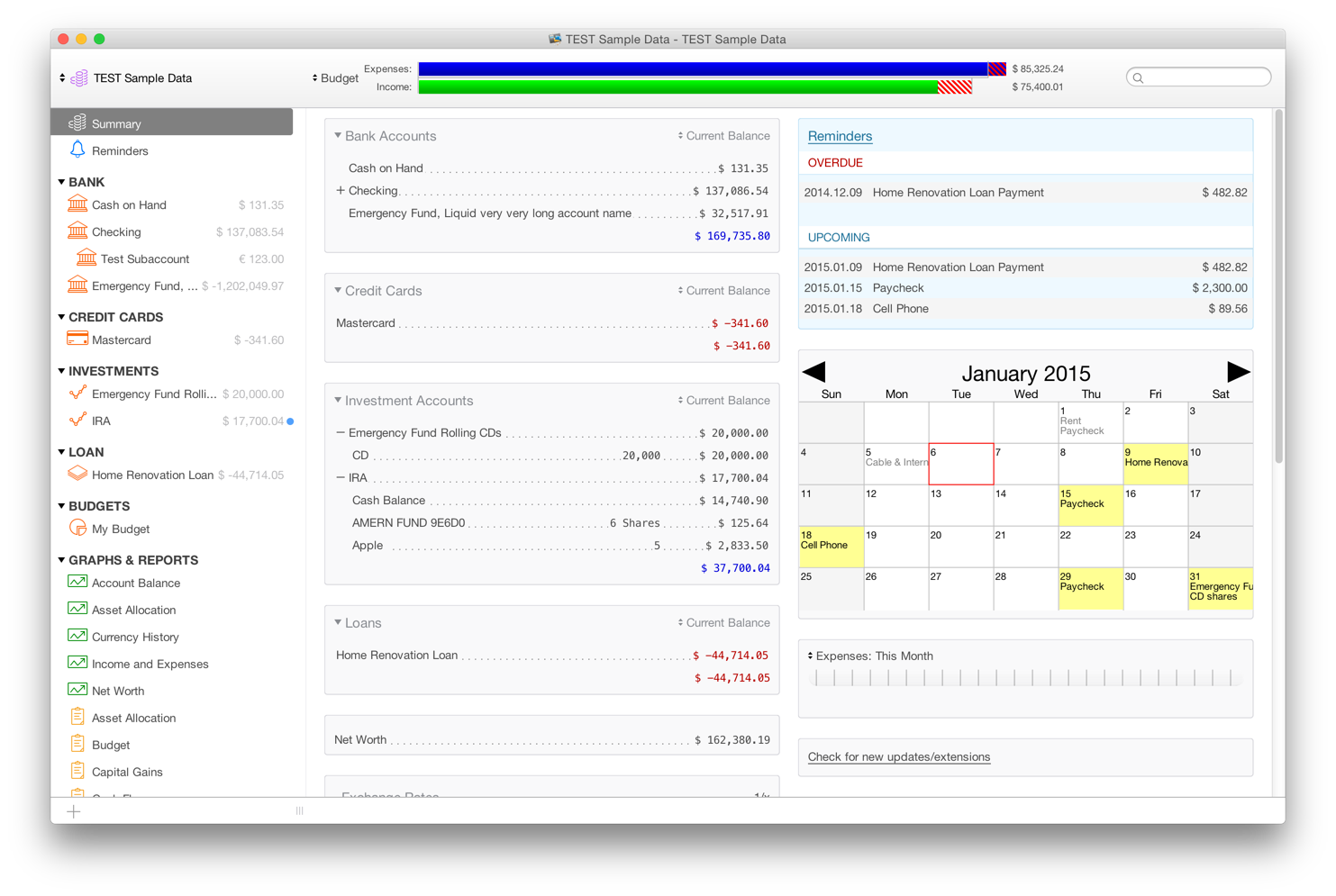

As with any software program, there are professionals and cons to the use of it. Everyone likes to do matters otherwise and every private finance manager does things it is own manner, at least a little. One of the primary things I do now not like approximately Moneydance is the way it installs on my Mepis gadget. Actually, I assume that has greater to do with me being used to doing things the Linux manner, so that certainly isn’t always a complaint. Once established, Moneydance is extraordinarily smooth to use. It opens up to the home page and there are a variety of items you can have displayed up there. You can see from the screenshot underneath that mine is quite easy. I do now not have stocks or bonds, but you could display inventory quotes if you need. Just add an investment account after which add the shares from your portfolio into that account.

One of the matters I virtually like about the way the house page is installation is the transaction reminders, each the listing and the calendar. It could be very smooth to inform what gadgets I actually have due, developing or maybe late. It is likewise very easy to feature new reminders via clicking at the hyperlink at the top. The fantastic component approximately the reminders is that you could use them for transactions or just a preferred reminder. The transactions may be set up to be entered mechanically or simply to remind the person to enter them manually.Overall, the home web page of Moneydance could be very usable and it is able to be edited to feature or put off items that you do or do not want or need. As you may see, I display my checking account, as well as each of my credit score card money owed on the left side. That allows me to look at a short look what I have in my bills.

Budget download - Moneydance for Mac 2017.8 (1691) download free - The Most Intuitive Personal Finance App - free. software downloads - best software, shareware, demo and trialware. Moneydance Personal Finance Manager for Mac Online Code by The Infinite Kind. Platform: Mac OS X 10.7 Lion, Mac OS Sierra 10.12, Mac OS X 10.8 Mountain Lion, Mac OS X El Capitan 10.11, Mac OS X 10.10 Yosemite, Mac OS X 10.9 Mavericks 4.0 out of 5 stars 1 rating. Price: £43.04: Price includes VAT if applicable. Learning to Use the New Personal Finance Software. You will have a slight learning curve when navigating any new personal finance software that replaces Microsoft Money. Some aspects of the new personal finance software will be easy to use for former Microsoft Money users, but be patient as you learn how to get around in the software.

As with any personal finance manager, the primary coronary heart of the program lies in its sign in or ledger. That’s where the bulk of the work is executed within the application and that is wherein I spend a maximum of my time, coming into transactions and reconciling with my bank account. It is inside the register that I had to learn to do matters a little differently than I turned into used to doing. For instance, there may be no keyboard shortcut to mark a transaction cleared or reconciled. You can do so by way of right clicking on the transaction and selecting it from the context menu and even as it gets the process finished, I find it a piece bulky to do. However, there’s every other way to accomplish this that works thoroughly and upon getting used to it, I locate it much easier to reconcile the sign in with my online bank declaration.

You can see the screenshot to the right that there’s an Actions hyperlink at the top left of the sign-up display. Clicking on it drops down a menu with a reconcile movement. Choosing that brings up a dialog that lists the beginning statement balance and asks me to enter the ending statement balance, which is basically the goal stability that I want to complete up with. Before I get to date, I even have already checked out my online financial institution declaration and feature that parent noted. Once this is entered, Moneydance brings up a small window that lists all of my transactions that are not cleared or reconciled. That window may be placed at once over the Firefox tab containing my financial institution statement and from there, I can use the mouse to mark the transactions cleared and spot how my sign up stability fits up with the bank statement. I can see in no time if there may be a mistake on the sign-up, without ever opening the bank assertion I receive inside the mail.

I have located that the usage of this small window absolutely speeds up my paintings in ensuring the transactions are correct and the web financial institution statement and my check in balance are correct. It saves me quite a few time and effort with the aid of not having to alt+tab to and fro between windows. As I said, it took me some time to get used to doing things that manner, however as soon as I did, it makes clearing a variety of transactions plenty less difficult and faster. I am quite set in my methods, but that is one aspect I actually have found out to do in a different way and satisfied I did.

Another feature I discover very beneficial is the manner Moneydance can backup my money file without a action from me, after the initial setup is carried out. I make each day backups in a folder on a very separate partition and Moneydance looks after the relaxation. Trust me, the backups have stored my bacon greater than once or even if I do not have a hardware problem, it without a doubt came in reachable when I set up SimplyMepis eight. It becomes a snap to load my backup record and feature all of my data handy. I have observed its miles important to hold backups and Moneydance offers you an expansion of options to choose from.

There is an extra aspect that I determined to be a piece unique from maximum different private finance packages I even have used and that is the manner Moneydance treats bills and classes the identical. I am no accountant, however, this is certainly the way maximum real accounting software It’s referred to as the double entry technique and at the same time as I do not apprehend it completely, it essentially links the one of a kind bills to every different. In KMyMoney and other private finance managers, you may set up a switch from one account to any other by means of calling it a transfer. In Moneydance, I had to choose the account within the category phase of the transaction for you to get the adjustments to register for both debts. Once I was given past the difference, it’s a piece of cake.

As with maximum private finance managers, Moneydance recalls the transactions and could complete them mechanically for you. If I input a transaction to Aldi’s to buy groceries, it remembers that and until I inform in a different way, all transactions to Aldi’s could be entered into the “Food: Groceries” class. That is available in very available and I can install a reoccurring transaction by using right clicking on the transaction line and telling Moneydance to “Memorize” the transaction. Very short and really smooth to do. I think I should say that Moneydance is very intelligent inside the check-in and the way it handles the transactions.

I should move on and on about the functions of this system, but this text is already longer than I had predicted. Suffice it to say that I am quite pleased with Moneydance. Yes, there are matters that I would like to see changed. For instance, the simplest way to cover past transactions inside the register is to archive them, however, I actually have determined that the range of transactions in the check-in would not seem to slow this system down, so I am residing with that. It’s just a depend on personal choice in that regard. The documentation may also be a little more thorough, however, I even have labored beyond that as well. If you are searching out an easy to apply non-public finance supervisor, I might urge you to provide Moneydance a strive. I do not assume you may be dissatisfied.

Moneydance is a budgeting tool similar to Quicken but only charges a one time fee of $49.99, rather than expensive monthly charges.

With Moneydance you can monitor your banking and investment accounts all in one place – using your computer and phone. It’s also possible to handle multi-currency transactions and pay your bills directly from Moneydance.

This in-depth Moneydance review can help you decide if this is the best premium personal finance app for managing your money.

Moneydance is free for the first 100 transactions. After that, you can purchase the software for a one time fee of $49.99.

What makes Moneydance different than most apps is its open-source API. Developers can create customized extensions that add new financial tools without upgrading to a new software version every year.

Some of the core Moneydance capabilities include:

Moneydance is a robust platform. Your entire financial universe assembles in one place. Moneydance can automatically download financial transactions and sort them into their proper categories. You can also build a custom budgeting strategy including importing your existing budget spreadsheets.

Accessing all your accounts in one place makes tracking your money simple. Your Moneydance charts and graphs give you a visual picture of where your money's going. The charting can be particularly beneficial for anyone with difficulty tracking spending.

Many budget-focused apps have mediocre investment tracking – at best. Moneydance can track your savings, mutual funds, stocks, bonds, and other investments. Not only does it keep track of your investments, but it also displays the performance of each.

You can also pay bills from the app, as well as receive alerts to remind you when payments are due. The last feature can save you money by helping you to avoid late fees.

Like any personal finance app, there is a small learning curve to efficiently navigate the software. Moneydance is not frustration-free. There can be programming bugs with importing data files and syncing your accounts. But you will find that with any software.

Moneydance remains a “desktop-first” budgeting app and is compatible with these operating systems:

The Android or Apple mobile app is a good companion and syncs with your desktop using Dropbox. However, the Moneydance mobile app lacks many desktop features and other cloud-based apps are better.

Moneydance is available for Windows, Mac, and Linux, as well as iOS and Android mobile phones.

The many banking and investment features can make Moneydance the only personal finance app you use. Most apps specialize in either budgeting or tracking net worth and investments. It’s not often that you can do both with one program.

You probably have online banking through each individual bank but what if you have several accounts in two or more banks?

The Moneydance online banking can be a serious benefit when you have accounts at multiple banks. You can access each account from the same app.

Moneydance automatically downloads your transactions, then automatically categorizes them to help you track your spending. You can also make payments directly from the app.

Some budgeting apps are excellent at tracking your finances and money goals. However, you must still use your bank app to schedule single or recurring online bill payments. Moneydance lets you pay bills from its platform using Direct Connect – the same program that Quicken and Quickbooks use.

Many national and regional banks support Moneydance for online bill payments and downloading transactions.

You can use this tool to schedule either individual payments or recurring transactions. Use it and you'll never forget a payment again.

This is your high altitude view – the big picture of your finances.

Some “all in one” finance apps excel at aggregating your account data but make it difficult to navigate your accounts.

The Moneydance summary dashboard provides these details:

While everything is summarized on one page, you can click on an account, or choose one from the drop-down list, to go directly to that account. There you can enter transactions, or reconcile your account.

Moneydance allows you to set budgets by category, for example, you may set a budget for restaurants. When a transaction comes into your checking account for a restaurant you can categorize that as such.

It’s also possible to assign “tags” to the transactions you categorize too. These tags can be handy when running budget reports and analyzing spending trends. For example, you might tag all of your expenses while on vacation as “travel”. You can then pull reports and see exactly how much your recent vacation was.

Here you can enter or delete transactions, or make any edits necessary. It's set up like a traditional checkbook, but it automatically calculates your balances and sorts your transactions. It also has an auto-complete feature for recurring transactions to save time.

The graphing tools enable you to generate visual reports tracking both your income and expenses.

You can create any type of graph you're comfortable with, and customize it with the desired date range and any other parameters you choose. Graphs can also be printed or saved on your computer.

Some of the available graphs include:

You may also appreciate the in-depth analysis that budget reports offer. These reports can make it easy to track your personal or business figures.

Some of the potential budget reports include:

There are multiple investment performance reports you can run too. For instance, some of the investment-related reports let you track cost basis, capital gains, portfolio performance, and transactions.

Tracking your investments is where Moneydance departs from many of the pure budgeting apps. It enables you to follow your investments not only by updating the total value of your portfolio but also by providing the performance of individual securities.

You can track stocks, bonds, certificates of deposit, mutual funds, and just about any other type of investment. Brainfevermedia software suite for mac free download.

You can customize investment tracking by setting it to automatically download daily security prices. Msg viewer pro 1 3 1 download free. It can also help you to perform cost basis computations, as well as to account for stock splits.

If you do any foreign currency transactions or have a foreign-based bank account, you'll really appreciate this feature.

Moneydance can handle multiple currencies and will make automatic conversions. It keeps a history of conversion rates too so your transaction from two years ago uses an accurate figure from that exact day.

There's no need to get out your calculator and look up daily exchange rates. It all happens automatically.

Moneydance can be purchased for a flat fee of $49.99. This one-time fee is an advantage over competing platforms that have monthly fees or a recurring annual fee. Chumba casino online.

You can make your one-time fee upfront, then use the app forever. Payment can be made by Visa, MasterCard, American Express, Discover, PayPal, or Amazon gift cards.

Each personal license is good for every computer in your household with unlimited use.

Adobe all versions. For businesses, Moneydance requests one license per computer or data file (whichever is smaller). You can share data files between multiple computers and only buy one license.

Moneydance offers a free trial for your first 100 manually entered transactions. You have full access to the app during the trial period. Once you reach that threshold, you can make the one-time payment and continue using the app. Or not.

The Moneydance app comes with a 90-day money back guarantee. If you're not happy for any reason, you can return the product for a full refund.

After you purchase the software you get one free major release update. After your free update, you will receive subsequent updates at half price.

Quicken, and most other software packages, makes you pay full freight with each major upgrade.

Moneydance and Quicken are two of the most powerful personal finance programs on the market. Quicken offers a similar experience to Moneydance for PC and Mac. Both programs require a desktop download and their mobile apps syncs with your desktop file. Quicken dropped its cloud-only data storage a few years ago.

You might prefer Quicken as this program may sync with more banks and brokerages. And, Quicken offers chat and phone support while Moneydance only offers email support.

However, Quicken charges of yearly fee of either $34.99, $44.99 or $74.99 depending on your plan tier.

There are two great reasons to consider Moneydance instead of Quicken. First, personal households pay a one-time $49.99 for a lifetime license. The most similar Quicken plan tier costs $74.99 per year.

A second advantage of Moneydance is its customization potential. Developers can create extensions that don’t require you to upgrade to the latest version to enjoy. Quicken is more likely to require forced updates if you want to continue using their product.

One tidbit most long-time Quicken users may not know is that Intuit sold Quicken in 2016. A private equity firm now owns the platform but Intuit still owns the Quicken trademark. Intuit wants to focus their efforts on Quickbooks and TurboTax.

Here's our full review of Quicken.

Moneydance offers a free trial for 100 transactions and a 90-day money-back guarantee, so you can give it a reasonable test drive to see if you like it.

There are so many different budgeting software apps out there and it often comes down to which you'll be the most comfortable with. Some are fairly simple in nature, like EveryDollar, and others are slightly more complicated, like Quicken. Moneydance could be the app that works for you. If not, here's our list of some great personal finance apps.

It goes beyond pure budgeting, by offering investment tracking and currency conversions. These will be more important to you if you have multiple investment accounts or regular foreign transactions.

If you'd like more information, visit the Moneydance website.